Contents

Introduction to Choice Supportive Bias in Personal Finance

The Impact of Choice Supportive Bias on Investment Decisions

Overconfidence in Past Financial Choices: Common Examples

Dangers of Choice Supportive Bias: Reinforcing Bad Money Habits

Navigating Emotional Attachments to Financial Decisions

Mitigating Choice Supportive Bias: Tools and Techniques

Cultivating Self Awareness and Reflective Decision Making in Personal Finance

The Power of Objective Financial Advice: Seeking Professional Help

Building a Strong Financial Future: Learning from Past Mistakes

Overcoming Choice Supportive Bias for Smarter Money Management

Introduction to Choice Supportive Bias in Personal Finance

Have you ever felt so convinced that a past financial decision was the absolute best? That’s choice supportive bias in action! It’s a psychological phenomenon where we unconsciously believe our previous choices were better than they actually were. This can lead to overconfidence in our ability to make sound financial decisions, potentially risking our financial future.

In personal finance, choice supportive bias can make us stick to investment strategies or money habits that may not serve our best interests. By becoming aware of this cognitive bias and taking steps to counteract its influence, you can make more informed and rational decisions to achieve your financial goals.

In this chapter, we will explore the impact of choice supportive bias on your personal finance decisions, provide practical tips to overcome it, and help you build a stronger financial future. It’s time to break free from the limitations of your past choices and confidently forge a new path to wealth and financial independence.

The Impact of Choice Supportive Bias on Investment Decisions

Imagine you invested in a particular stock a few years ago and are convinced it was an excellent choice. But in reality, the stock has underperformed compared to the broader market. Despite this, you continue to hold on to it, convinced it will eventually turn around. This is a classic example of a choice-supportive bias influencing your investment decisions.

Choice supportive bias can lead you to ignore or downplay the negatives of your past investments, making it difficult to evaluate their true performance objectively. As a result, you may hold on to underperforming assets for too long, miss out on better investment opportunities, or allocate too much capital to a single investment. This could potentially hurt your overall portfolio’s growth and hinder your journey to financial independence.

Recognising when choice supportive bias affects your judgment is crucial to make smarter investment decisions. Learn to objectively evaluate your investments’ performance and adjust as needed without letting emotions cloud your decision making process.

Believing that choices made in the past were better than they actually were, leading to overconfidence in past financial decisions.

Overconfidence in Past Financial Choices: Common Examples

Choice supportive bias can manifest itself in various personal finance scenarios. Here are some common examples:

- Sticking with a high fee mutual fund, believing it has been providing great returns, despite evidence suggesting that low cost index funds outperform it.

- Continuing to use a credit card with high interest rates and annual fees, assuming it offers the best rewards, without exploring other options in the market.

- Failing to diversify your investment portfolio because you’re convinced that a particular asset class (e.g., real estate or stocks) will always outperform others.

These examples demonstrate how choice supportive bias can lead to irrational financial decisions, resulting in suboptimal outcomes. Awareness of these biases is the first step towards overcoming them and making more rational choices.

Dangers of Choice Supportive Bias: Reinforcing Bad Money Habits

When we’re blinded by choice supportive bias, it’s easy to overlook the consequences of our financial decisions. We might continue to make the same mistakes, reinforce bad money habits, and limit our potential for growth. By rationalising our choices and remaining overconfident, we can miss opportunities to learn, grow, and ultimately reach our financial goals.

For example, if you consistently spend beyond your means and justify it by saying you deserve to treat yourself, choice supportive bias may prevent you from recognising the harm this behaviour causes to your financial health. By ignoring the issue and not addressing the underlying habits, you may find yourself in debt and struggling to build wealth.

To break free from the vicious cycle of choice supportive bias, it’s essential to confront our bad habits, accept our mistakes, and work towards creating healthier financial behaviours.

Navigating Emotional Attachments to Financial Decisions

Our emotional attachment to past decisions can make it difficult to recognise when choice supportive bias influences our judgment. We might feel a sense of loyalty or pride towards a particular investment or financial strategy that clouds our ability to see things objectively.

To overcome this, start by acknowledging the emotional aspect of your financial decisions. Recognise that it’s natural to have feelings about your money and that these emotions can sometimes lead to biased judgments. By being aware of your emotions, you can begin to separate them from the facts, allowing for more rational decision making.

One strategy to help navigate emotional attachments is to practice viewing your financial choices from a third-party perspective. Imagine that you are advising a friend or family member on their financial situation—what would you recommend they do? This can help you gain a more objective view of your decisions and determine whether they truly serve your best interests.

Mitigating Choice Supportive Bias: Tools and Techniques

Now that you understand the impact of choice supportive bias on your personal finance decisions, let’s explore some tools and techniques to mitigate its influence:

- Keep a financial journal: Document your financial decisions and their rationale. This will help you reflect on your choices and analyse them objectively.

- Create an investment policy statement (IPS): Outline your investment objectives, risk tolerance, and strategies. This will provide a framework to evaluate your investment decisions and keep you on track towards your goals.

- Seek diverse perspectives: Discuss your financial choices with trusted friends or family members who can offer objective insights and help you see things from different angles.

- Regularly review and adjust: Periodically assess your financial choices and make necessary adjustments to stay aligned with your goals and changing circumstances.

Implementing these tools and techniques can counteract choice supportive bias and develop a more objective approach to personal finance decisions.

Cultivating Self Awareness and Reflective Decision Making in Personal Finance

Developing self awareness and the ability to reflect on your decisions is essential to overcoming choice supportive bias. By taking the time to pause and think critically about your financial choices, you can learn from your past experiences and make better decisions moving forward.

Begin by examining the reasons behind your financial choices. Are they based on facts and sound analysis, or are they driven by emotions or a belief that your past choices were always the best? Reflect on what you would do differently if you could return in time, and use these insights to inform your decisions.

Remember that nobody is perfect, and everyone makes mistakes. The key to success in personal finance is learning from those mistakes and using that knowledge to make better choices moving forward.

The Power of Objective Financial Advice: Seeking Professional Help

When dealing with choice supportive bias, seeking professional financial advice can be invaluable. Financial advisors can provide an objective perspective on your financial situation and help you make more informed decisions.

By working with a financial professional, you can identify areas of your financial plan that may be influenced by choice supportive bias and receive guidance on adjusting your strategies. Additionally, a financial advisor can help you set realistic expectations and hold you accountable for achieving your financial goals.

Before selecting a financial advisor, ensure they have the credentials and experience to guide you. Look for a fiduciary advisor legally required to act in your best interests and prioritise your financial needs.

Building a Strong Financial Future: Learning from Past Mistakes

Embracing a growth mindset is key to overcoming choice supportive bias and building a strong financial future. By acknowledging that we can learn from our past mistakes, we can continuously improve our decision making process and make smarter choices that lead to financial success.

When you encounter setbacks or disappointments, view them as opportunities for growth and learning. Analyse what went wrong and identify the lessons you can apply to your future financial decisions. This approach will help you overcome choice supportive bias and empower you to take control of your financial destiny.

Remember that the journey to financial independence is a marathon, not a sprint. Stay committed to learning and refining your financial strategies, and be prepared to adjust as needed. By staying adaptable and open minded, you can turn setbacks into valuable experiences that ultimately bring you closer to your financial goals.

Overcoming Choice Supportive Bias for Smarter Money Management

Choice supportive bias is a powerful psychological force that can lead to overconfidence in our past financial decisions, hindering our ability to build wealth and achieve financial independence. You can make more informed and rational financial decisions by becoming aware of this cognitive bias and taking proactive steps to counteract its influence.

Cultivate self awareness, embrace a growth mindset, seek objective advice, and develop the habit of regularly reviewing and adjusting your financial strategies. Doing so, you’ll be well equipped to overcome choice supportive bias and make smarter money management decisions that bring you closer to your financial dreams.

The journey to financial independence may be challenging, but with the right mindset, tools, and guidance, you can build a strong financial future and create the life of abundance you deserve. So learn from your past, and confidently forge a new path towards wealth and financial success.

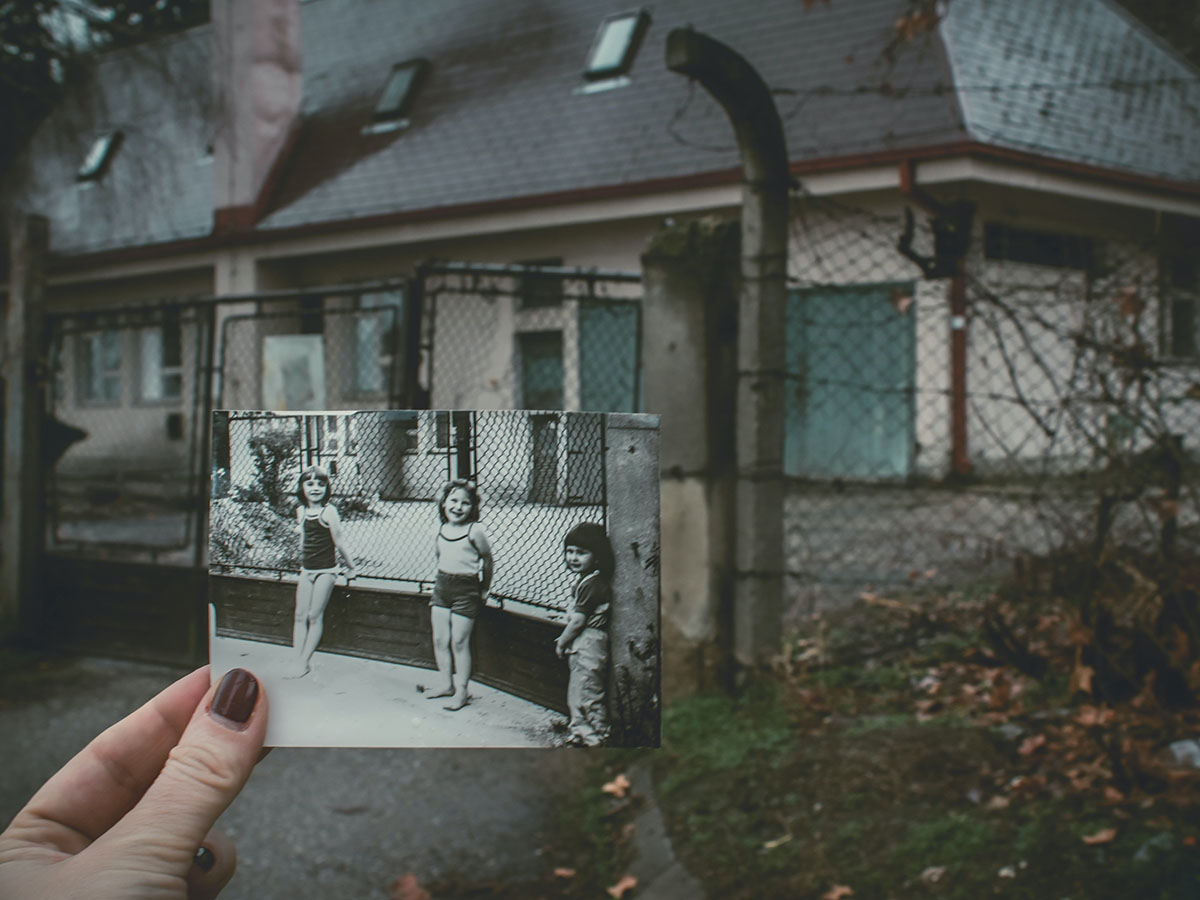

Image by Anita Jankovic